This information was generously shared by the Housing Opportunities Made Equal of Virginia, Inc. (HOME), as part of their Excluded Communities Project.

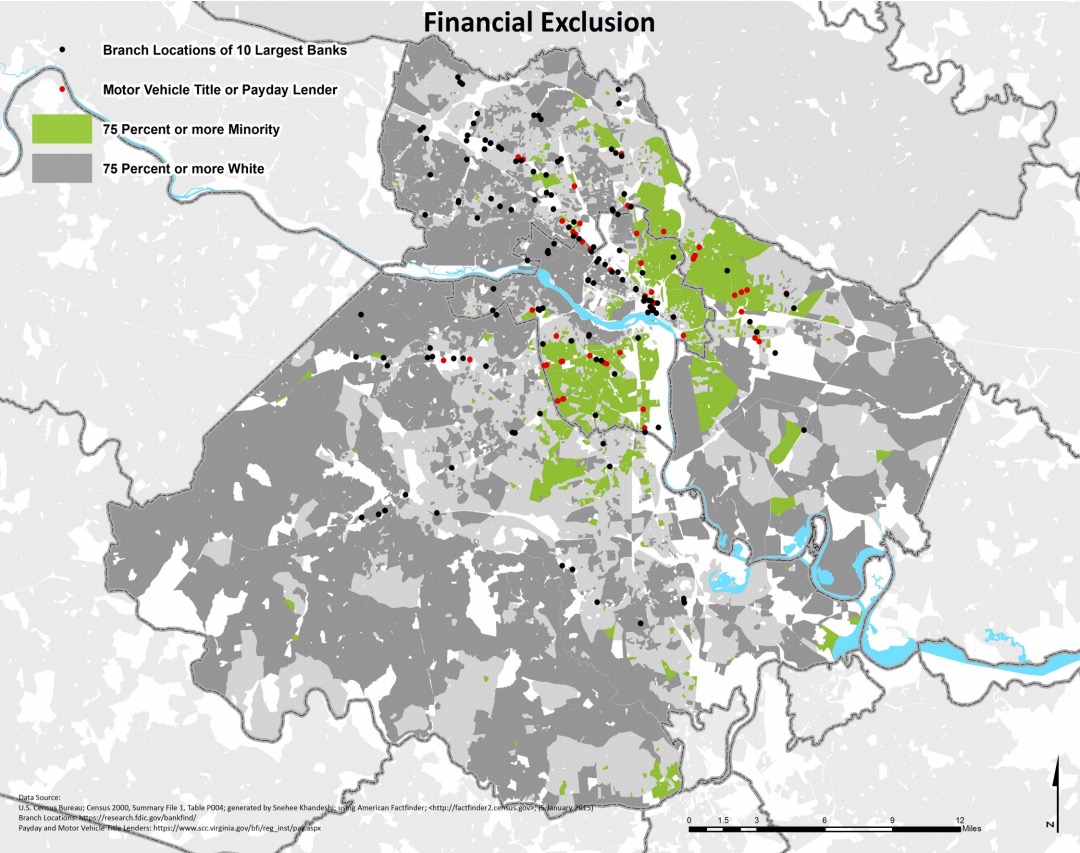

This map shows the branch locations of the 10 largest mortgage lenders and the locations of payday and motor vehicle title lenders in the region. Payday and title loans are high-cost, high interest loans. Title loans are secured by the title of a vehicle the borrower owns outright while payday loans are unsecured.

Payday and title lenders are primarily located in or near predominantly minority communities. Within the region, 37% of all minorities live within 1 mile of a payday or title lender compared to 13% of whites.

27 percent of the total white population lives within 1 mile of a branch of one of the ten largest mortgage lenders in the Region. 22 percent of minorities reside within 1 mile of a branch.

The predominant issue with payday and motor vehicle title loans is the intentional structuring of the loan as a debt trap for vulnerable borrowers. The loans are marketed as a quick and convenient solution to a financial emergency. However, they typically lead the borrower to a cycle of debt that is difficult, if not nearly impossible to escape. For title loans the end result is often the loss of the borrower’s vehicle, critically important to maintaining or securing employment.

Access to mainstream financial resources is foundationally important to the accumulation of wealth. According to the Federal Deposit Insurance Corporation (FDIC), 20.5% of black households are unbanked compared to just 3.6% of white households. This disproportionate access to mainstream financial resources directly impacts the ability to maintain and build credit, purchase a home, and escape the high interest rates charged by payday and title loan lenders.

Produced by Housing Opportunities Made Equal of Virginia, Inc. (HOME) as part of the Excluded Communities Project. Please visit homeofva.org to download a full copy of the report.